5 Tips about commercial bridge lender You Can Use Today

As the residence serves as collateral within the bank loan, There may be significantly less threat with the creditor and you may shut these loans inside a subject of a couple of days.

You can obtain a hard money or private money financial loan from an individual Trader or simply a lending organization with no obtaining a business background or excellent company credit score scores. But beware: these financial loans often include shorter repayment terms and rather steep fascination costs.

For that reason, They are really a game-transforming selection for any investor who wants rapidly, adaptable funding to seize alternatives in a competitive current market.

Group gamers collaborate with industry execs, and serial flippers juggle several tasks. Featuring financial loans tailored to every sort allows them improve income.

AVANA Capital can issue funding in as quick as 10 times. That’s the fastest with the lenders stated inside our guideline, rendering it a very good option if you need to go quickly on a property.

Hard money loans most often use real estate property as collateral, but other hard assets — like autos, gear, equipment and cherished metals — could also safe the personal loan. The standard terms for hard money financial loans vary from six to 24 months.

A lot of private lending transactions are unsecured, meaning no more collateral is necessary. Remember that there are actually authorized repercussions for not repaying the personal loan, as well as the property alone may very well be seized like a kind of collateral. However, considering that real-estate is remaining acquired Together with the loan money, hard money lender the lender may use this like a style of collateral within the arrangement.

The first advantage of a property personal loan of the mother nature is usually that it’s brief. Borrowers don’t should be worried about the prolonged software and underwriting strategy of conventional home loan loans.

RCN Capital gives “correct and flip” funding in 44 states. The lender finances projects on residential and mixed use Attributes, together with one-spouse and children homes and multiple-unit dwellings.

The higher price of a hard money bank loan is offset by The reality that the borrower intends to pay back the loan somewhat swiftly.

Versatile Terms: Custom-made loan phrases to match your real estate expenditure venture timelines and desires.

By contrast, lenders Appraise the deal alone. Normally, they care most with regard to the house's following-repair service worth (ARV) or an estimate of what the property is going to be really worth at the time renovations are comprehensive. They pay a lot less focus to your creditworthiness and tend to be more focused on the sustainability with the job.

Editorial Be aware: Our top rated precedence is always to supply you with the best economic details for your business. Nav might acquire compensation from our companions, but that doesn’t impact our editors’ thoughts or recommendations.

A lot of hard money lenders also need borrowers for making a down payment to the home. This may be close to twenty to 30% of the fee. Putting this money down up entrance lowers hazard for the lender and should allow for decrease desire prices plus more favorable phrases with the period with the mortgage.

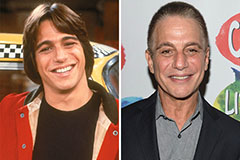

Tony Danza Then & Now!

Tony Danza Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!